The key to a good analysis - like in most types of analysis (!) - is to pick good projections going forward. While used often in many aspects of business to set strategy, it's also a useful analysis for evaluating investment choices.

FREE PROPERTY EVALUATOR CASH FLOW HOW TO

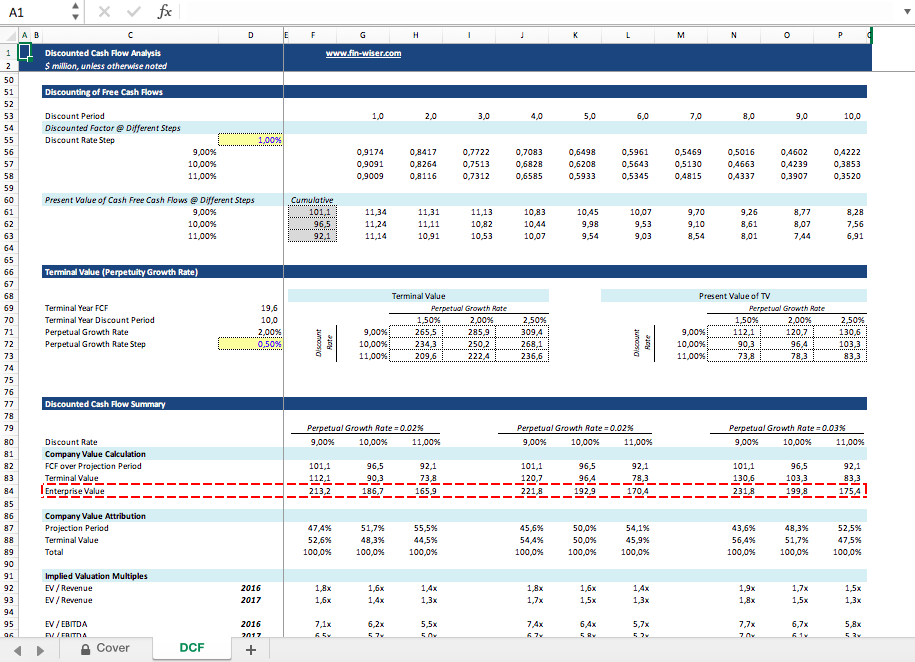

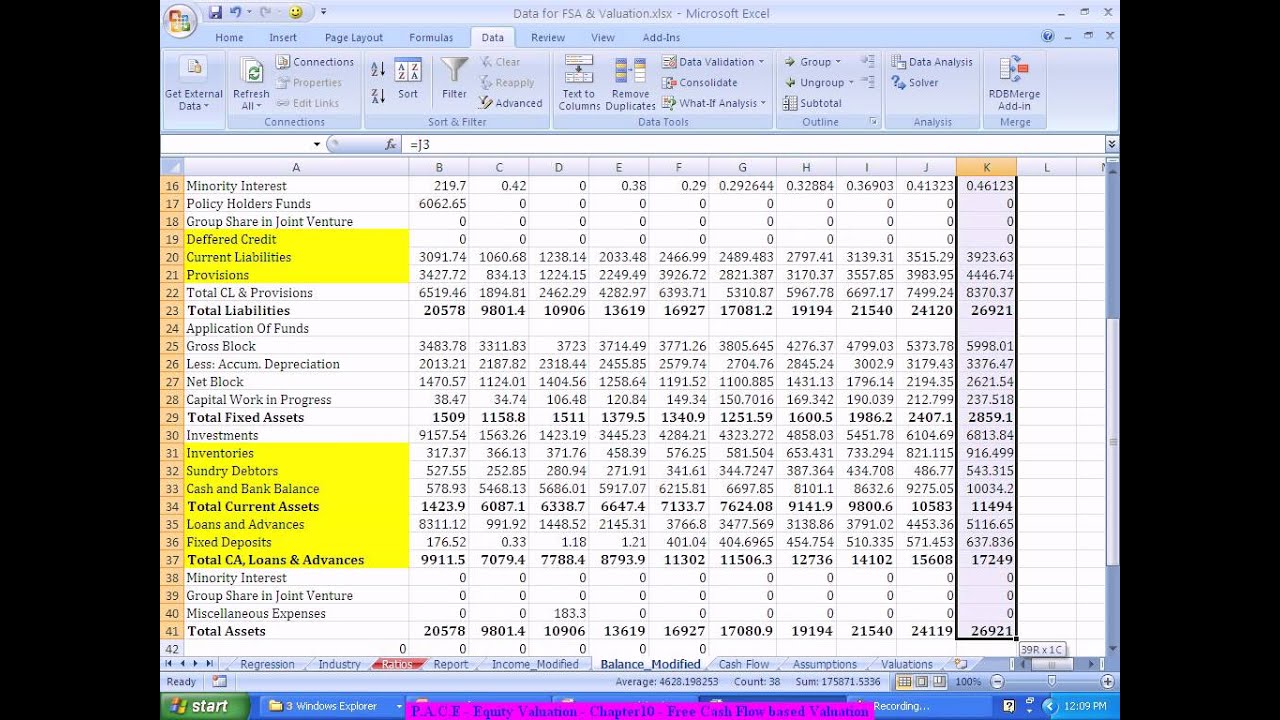

How to Use a Discounted Cash Flow Analysisĭiscounted cash flow analysis is a common technique to determine the contribution to present value of future cash flows.

FREE PROPERTY EVALUATOR CASH FLOW FOR FREE

The growth rate is applied in the very first year of simulation.

TTM Free Cash Flow Per Share ($) - The trailing 12 month, or annual, dollars of free cash flow per share of stock.Earnings Growth (%) - The annual rate of growth you expect for earnings per share, in the near term.TTM Earnings Per Share ($) - The trailing 12 month, or annual, dollars earned in profit per share of stock.Discount Rate (%) - Return you could earn on another security, sometimes called the 'guaranteed return' (even if not guaranteed!).Current Stock Price - The most recent trading price for the stock.Enter a trailing 12 month earnings per share (or free cash flow) amount and we apply growth from the first year. By default, it uses Earnings per Share to run valuations expanding the Advanced Options tab allows you to use Free Cash Flow instead. The discounted cash flow stock valuation calculator is relatively straightforward but allows customization with advanced options. 4 DCF: One Aspect of Your Stock Valuation Due Diligence Using the Discounted Cash Flow Calculator

0 kommentar(er)

0 kommentar(er)